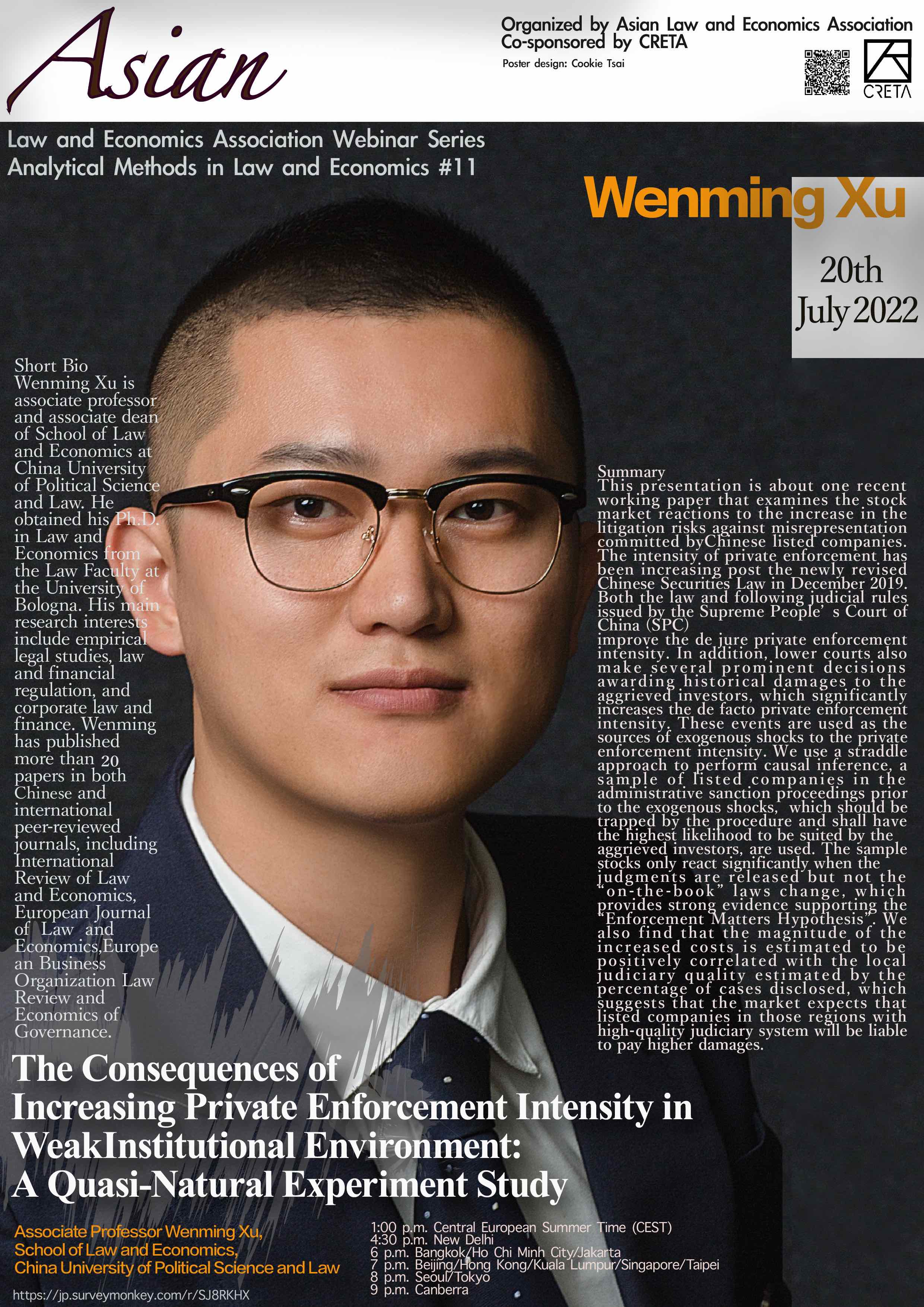

AsLEA Analytical Methods in Law and Economics #11

Professor Wenming Xu, School of Law and Economics, China University of Political Science and Law

Registration URL: https://jp.surveymonkey.com/r/SJ8RKHX

Date: July 20, 2022 (Wed.)

Time:

1:00 p.m. Central European Summer Time (CEST)

4:30 p.m. New Delhi

6 p.m. Bangkok/Ho Chi Minh City/Jakarta

7 p.m. Beijing/Hong Kong/Kuala Lumpur/Singapore/Taipei

8 p.m. Seoul/Tokyo

9 p.m. Canberra

Outline

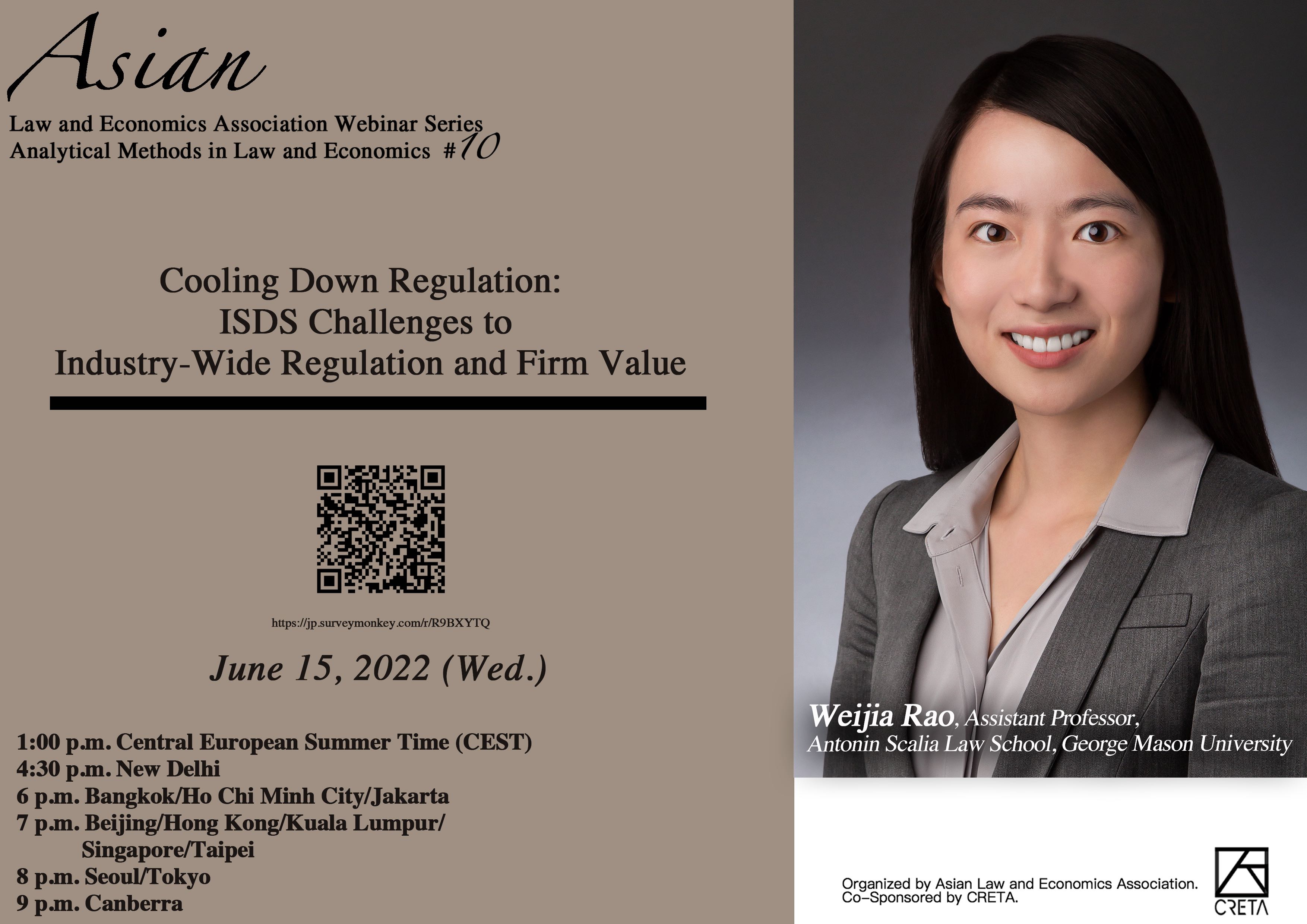

Cooling Down Regulation: ISDS Challenges to Industry-Wide Regulation and Firm Value

Professor Weijia Rao, Antonin Scalia Law School, George Mason University

Registration URL: https://jp.surveymonkey.com/r/R9BXYTQ

Date: June 15, 2022 (Wed.)

Time:

1:00 p.m. Central European Summer Time (CEST)

4:30 p.m. New Delhi

6 p.m. Bangkok/Ho Chi Minh City/Jakarta

7 p.m. Beijing/Hong Kong/Kuala Lumpur/Singapore/Taipei

8 p.m. Seoul/Tokyo

9 p.m. Canberra

Outline

In this paper, we examine how investor-state dispute settlement (ISDS) affects the value of foreign and domestic corporate investments. An ISDS case is likely to affect the market value of the foreign firm(s) which brings the case. It is less obvious, however, how (or whether) ISDS cases affect the value of investment more broadly, i.e., for other firms operating in the sector where a case is filed. One possibility is that, by providing a mechanism to limit costly government regulation, ISDS increases the value of both foreign and domestic investment in the case’s sector. We employ an event study to explore the effect of ISDS cases on the value of firms with investments in the affected sector relative to firms in non-affected sectors. We find evidence suggesting that regulatory challenges in ISDS benefit not only the claimant investor, but also other firms which are similarly affected by the challenged regulation.

Speaker’s profile

Weijia Rao is an Assistant Professor of Law at Antonin Scalia Law School, George Mason University. Her research applies empirical methods to the study of international and comparative law, with a focus on legal institutions governing global trade and investment. Her recent scholarship has been published or is forthcoming in the Journal of Legal Studies, International Review of Law and Economics, Harvard International Law Journal, Yale Journal of International Law, and Chicago Journal of International Law. She received her LLB and BA in Economics from Tsinghua University, and her LLM and JSD from the University of Chicago.

About the webinar series

In this webinar series, law and economics scholars will present their current research project and also guide the audience through the analytical techniques used in their research. The series aspires not only to be instructive for the entry-level researchers and graduate students, but also to be informative for more established scholars. The time duration is one hour, including a Q&A period.

Cameras in the Courtroom: A Field Experiment in Real Trials

Professor John Zhuang Liu, University of Hong Kong

Registration URL: https://jp.surveymonkey.com/r/6QXFVFV

Date: May 18, 2022 (Wed.)

Time:

1:00 p.m. Central European Summer Time (CEST)

4:30 p.m. New Delhi

6 p.m. Bangkok/Ho Chi Minh City/Jakarta

7 p.m. Beijing/Hong Kong/Kuala Lumpur/Singapore/Taipei

8 p.m. Seoul/Tokyo

9 p.m. Canberra

.

Outline

We conduct an experiment in a real court to study the effects of cameras in the courtroom. Collaborating with a local court in China, we randomly assigned trials to be or not to be live broadcast in a four-week period (N = 85). We find that the rate of speech (average speaking speed) of parties is 18% slower in the presence of live broadcast, implying they are more cautious (or, perhaps, nervous) in the presence of cameras. Meanwhile, their speaking speeds do not become normal after the first several minutes, suggesting they do not neglect the presence of cameras as time passes. The speech rate of repeat players, i.e., lawyers and judges, is not influenced by live broadcast; nor do we find evidence that live broadcast affects court decisions. Taken together, our evidence suggests that cameras affect parties, not lawyers and judges; the effects of live broadcasts are nevertheless limited, and unlikely to result in unfair trials.

.

Speaker’s profile

John Zhuang Liu is an Associate Professor at the University of Hong Kong. His interests include the role of the courts and judicial behavior, as well as law and development. His work has appeared in a number of top-tier academic journals that specialize in law and in China studies, including Journal of Legal Studies, Journal of Legal Analysis, Journal of Empirical Legal Studies, American Journal of Comparative Law, Journal of Comparative Economics, China Quarterly, and Journal of Contemporary China. He is now developing a structural database of Chinese court decisions in contract cases and criminal cases, aiding scholars who seek to conduct empirical studies of the Chinese legal system. He received a Bachelor of Laws and a Ph.D. in Law from Peking University, as well as an LLM and a JSD from the University of Chicago.

.

About the webinar series

In this webinar series, law and economics scholars will present their current research project and also guide the audience through the analytical techniques used in their research. The series aspires not only to be instructive for the entry-level researchers and graduate students, but also to be informative for more established scholars. The time duration is one hour, including a Q&A period.

Asian Law and Economics Association Webinar Series : Analytical Methods in Law and Economics #8

This webinar is intended for junior scholars who are interested in empirical legal studies in corporate law. In this lecture, I will first introduce the development of empirical corporate law studies in the U.S. I will analyze the impact of the seminal “law and finance” research by LLSV (La Porta, Lopez-de-Silanes, Shleifer, and Vishny) and the pioneering study on firm-level governance by GIM (Gompers, Ishii, and Metrick) on later corporate law research to understand the development path of empirical corporate law studies. Then I will use research studies on corporate governance as examples to discuss common research designs for empirical studies and causal inference, such as difference-in-differences, event study, regression discontinuity, and instrumental variable. After this webinar, participants will have a fundamental understanding of basic empirical research designs.

Speaker’s profile

Lauren Yu-Hsin Lin is an Associate Professor at City University of Hong Kong. Her research interests include corporate governance, corporate finance, capital markets, and securities regulation. She employs empirical methods to dissect and understand the effect of different governance rules and regulatory measures on corporations. Her research on Chinese corporations has generated policy impacts leading to rule changes and has been cited by the Delaware Court of Chancery, the U.S. Securities and Exchange Commission (SEC), and the U.S.-China Economic and Security Review Commission (USCC). Her works have appeared in several leading academic journals, such as the Journal of Legal Studies and the Journal of Empirical Legal Studies.

Power and Position: Antitrust Analysis in the Age of Big Tech

4:30 p.m. New Delhi,

6 p.m. Bangkok/Ho Chi Minh City/Jakarta

7 p.m. Beijing/Hong Kong/Kuala Lumpur/Singapore/Taipei,

8 p.m. Seoul/Tokyo,

10 p.m. Canberra

Analytical Methods in Law and Economics #7

Professor Yong Lim, Seoul National University School of Law

Professor Bingwan Xiong, Renmin Law School

A simple registration from the URL below is required to receive the Zoom link to this session.

URL: https://jp.surveymonkey.com/r/BPM32J5

Time:

noon Central European Time (CET)

4:30 p.m. New Delhi,

6 p.m. Bangkok/Ho Chi Minh City/Jakarta

7 p.m. Beijing/Hong Kong/Kuala Lumpur/Singapore/Taipei,

8 p.m. Seoul/Tokyo,

10 p.m. Canberra

Bingwan Xiong is associate professor at Renmin Law School, where he teaches Contracts and E-commerce Law. He directs the Center of Platform Governance at Renmin University Institute of Law and Technology. Professor Xiong graduated from Renmin Law School (LL.B., LL.M., and Ph.D.) and Harvard Law School (LL.M.). He has published on a wide range of subjects about private law, law and technology in leading Chinese law journals and peer-reviewed English journals. He is co-editor of the English translation of Chinese Civil Code, which was published by Brill in 2021.

In this webinar series, law and economics scholars will present their current research project and also guide the audience through the analytical techniques used in their research. The series aspires not only to be instructive for the entry-level researchers and graduate students, but also to be informative for more established scholars. The time duration is one hour, including a Q&A period.

Asian Law and Economics Association Webinar Series

Professor OTA Shozo, Meiji University School of Law

Traditional legal studies were not scientific enough in methodology. In order to provide appropriate solutions to social and economic issues, it is necessary to make legal methodologies more scientific and convincing. In this lecture, I will explain how to incorporate the latest methodologies of the other social and natural sciences into legal research, using the following examples: (1) an empirical study on the “lawyers’ quality of civil legal practice,” where more than 100 experienced lawyers cooperated in evaluating real court documents, (2) randomized controlled comparison of people’s attitude toward AI-Court, where internet surveys were conducted with experimental research design, and (3) a brain-scientific study on “legal mind” using fMRI on legal experts and laypersons with cooperation by neuro-politics, brain-science, socio-legal, and criminal law scholars.

Shozo Ota is a professor at Meiji University School of Law and an emeritus professor at the University of Tokyo. He is a pioneer in interdisciplinary legal research in Japan, and he worked with scientists in other fields, such as computer science, neuro-politics, and brain science, and served as the head of the Advanced Interdisciplinary Research Center at the University of Tokyo. His research interests include law and economics, law and society, and empirical legal studies, and he has published papers in internationally recognized journals. He has been a visiting professor or scholar at UC Berkeley, Columbia, and Michigan.

In this webinar series, law and economics scholars will present their current research project and also guide the audience through the analytical techniques used in their research. The series aspires not only to be instructive for the entry-level researchers and graduate students, but also to be informative for more established scholars. The time duration is one hour, including a Q&A period.

Asian Law and Economics Association Webinar Series

Professor Sangchul Park, Seoul National University School of Law

About the webinar series

In this webinar series, law and economics scholars will present their current research project and also guide the audience through the analytical techniques used in their research. The series aspires not only to be instructive for the entry-level researchers and graduate students, but also to be informative for more established scholars. The time duration is one hour, including a Q&A period.

Analytical Methods in Law and Economics #3

URL: https://forms.gle/wDDe5WEWM3gErNH96

Time:

4:30 p.m. New Delhi,

6 p.m. Bangkok/Ho Chi Minh City/Jakarta

7 p.m. Beijing/Hong Kong/Kuala Lumpur/Singapore/Taipei,

8 p.m. Seoul/Tokyo,

9 p.m. Canberra

An Introduction to the Concept of Efficiency in Law and Economics

Professor Yun-chien Chang, Research Professor & Director of Center for Empirical Legal Studies Institutum Iurisprudentiae, Academia Sinica, Taiwan.

This webinar is intended as a methodological primer for beginners in law and economics, but seasoned experts may also find the explanations novel. Efficiency, along with cost and benefit, is the most often used concept in law and economics. What does it mean? What are the relationships between Pareto, Kaldor-Hicks, allocative, and productive efficiency? Is efficiency coterminous with cost-benefit analysis? In different legal fields, such as contract, torts, (intellectual) property, civil procedure, business organization, etc., is efficiency operationalized in the same way? If willingness to pay is the part and parcel of efficiency analysis, how could legal scholars claim anything about efficiency without surveying everyone and asking them hypothetical questions (and assuming that people give honest and accurate answers!)? When and how should transaction cost be part of the analysis? This webinar will untangle these fundamental questions and give a step-by-step thinking module of how to conduct efficiency analysis.

About the webinar series

In this webinar series, law and economics scholars will present their current research project and also guide the audience through the analytical techniques used in their research. The series aspires not only to be instructive for the entry-level researchers and graduate students, but also to be informative for more established scholars. The time duration is one hour, including a Q&A period.

Asian Law and Economics Association Webinar Series

Analytical Methods in Law and Economics #2

A simple registration from the URL below is required to receive the Zoom link to this session. This is separate from registration to the July session or mailing list (Registration is required for each session).

URL: https://forms.gle/MzgQyYt1FL2C8jh1A

Date: Aug 18, 2021 (Wed.)

Time:

4:30 p.m. New Delhi,

6 p.m. Bangkok/Ho Chi Minh City/Jakarta

7 p.m. Beijing/Hong Kong/Kuala Lumpur/Singapore/Taipei,

8 p.m. Seoul/Tokyo,

9 p.m. Canberra

“Mandatory Bids in China: You Can Lead a Horse to Water, But You Can’t Make It Drink”

European Business Organization Law Review (2021) 22:351?394

Professor Wei Zhang, Singapore Management University Yong Pung How School of Law

Summary

The mandatory bid rule is prevalent across jurisdictions of both civil law and common law traditions. Yet empirical evidence about its functioning is rare. This paper studies mandatory bids in China against an institutional backdrop of restrictive IPO requisites. We find that virtually no shares held by external shareholders are tendered in mandatory bids for all the remaining shares. Mandatory bidders’ tactics to avoid tendering by public investors include pressing down their bid prices, and potential manipulation of target stock prices. In relation to economic impacts of mandatory bids, we document that market responds favourably to their announcements, and that targets’ operational performance improves in their wake, consistent with the theoretical prediction that mandatory bids induce efficient transfers of corporate control. Our research is among the earliest empirical works on the mandatory bid rule in a particular jurisdiction. It not only yields interesting results pertaining to the unique Chinese regulatory environment, but also generates useful insights about mandatory bids beyond China.

Zhang Wei is an Associate Professor and the Associate Dean of the Yong Pung How School of Law at the Singapore Management University. He received his basic law degree from Fudan University, his Masters in Laws degrees from Waseda University and Harvard Law School. He earned his Ph.D. in Jurisprudence and Social Policy from UC Berkeley. His main research areas include corporate and securities law, property law and Chinese law. He has published widely on these topics in both English and Chinese.

About the webinar series

In this webinar series, law and economics scholars will present their current research project and also guide the audience through the analytical techniques used in their research. The series aspires not only to be instructive for the entry-level researchers and graduate students, but also to be informative for more established scholars. The time duration is one hour, including a Q&A period.

Tentative dates for 2021 are as follows:

Sep 15 // Oct 20 // Nov 17 (3rd Wednesday of every month).

Asian Law & Econ Association Webinar – Albert Choi

Asian Law and Economics Association is launching a webinar series! Please see below for details.

Asian Law and Economics Association Webinar Series

Analytical Methods in Law and Economics #1

Wed., July 21, 2021

4 pm New Delhi // 6 pm Bangkok

7 pm Beijing/Hong Kong/Kuala Lumpur/Singapore/Taipei

8 pm Seoul/Tokyo // 9 pm Canberra

“Initial Public Offering and Optimal Corporate Governance”

Professor Albert H. Choi, University of Michigan Law School

Summary

This project examines the long-standing debate over whether firms have a market-based incentive to adopt the optimal governance structure at the initial public offering (IPO). Various scholars and practitioners have argued that firms (with the founders) have an incentive to adopt the optimal corporate governance structure at the IPO, while others have empirically challenged such assertions. The project attempts to bridge this gap with the help of a simple game theory and examines the conditions under which firms may adopt suboptimal governance features at IPO.

Professor Choi received a J.D. from Yale Law School and a Ph.D. in economics from MIT. He is a Co-Editor of American Law and Economics Review. His research and teaching interests include corporate law, contract law, corporate finance, mergers and acquisitions, and law and economics. He has published numerous papers in leading journals, such as the Yale Law Journal, American Economic Review, Journal of Law and Economics, and Journal of Legal Studies.

Registration

If you would like to participate, please access the URL below and register. We will send a Zoom link to the registered email address.

URL: https://forms.gle/wDvoUw1G4SZfHZPFA

About the webinar series

In this webinar series, law and economics scholars will present their current research project and also guide the audience through the analytical techniques used in their research. The series aspires not only to be instructive for the entry-level researchers and graduate students, but also to be informative for more established scholars. The time duration is one hour, including a Q&A period.

Tentative dates for 2021 (to be finalized and announced separately) are as follows:

Aug 18 // Sep 15 // Oct 20 // Nov 17 (3rd Wednesday of every month).